Forward in time IAA Transportation 2022

IAA Transportation showcases what’s at the forefront of road transport in Europe… and, let’s face it, the world. In 2022, the message was clear: we are no longer on the cusp of change; it is taking place all around us.

From the moment you entered the first pavilion at IAA Transportation in Hanover this year, any cynicism you may have still harboured regarding the changing nature of global road transport, would have been well and truly crushed beneath the wheels of our electric and biofuel future.

That shock was even more impactful thanks to the Covid- induced binning of the 2020 event. Daimler Truck CEO Martin Daum’s opening-night remark on his company’s stand, “A lot has happened since our last IAA”, redefined understatement in the same way Benz himself redefined mobility. Standing amid it all, with four years since the last IAA edition, we may as well have been on a different planet at times. This event was an alternative fuel and transport methodology rethink, with names that reassured us, and others that had us scrambling for Google to answer the ‘who’ question.

At times, there was a scent of paradox in the air. In the world outside the pavilions, diesel is still very much in charge. Stroll onto the side of the autobahn and what’s moving the world today is rooted in the Mesozoic Era rather than the ‘Lithionic’. However, with their hands forced by signatures on the bottom of carbon-reducing obligations, the OEMs are now focused on the windscreen, not the rear-view screens. Those obligations mean they also must act quickly, not just for reasons of planetary welfare, but cost. Regardless of how big you are, attempting to effect three generations of R&D in one, with no real clarity as to where the eventual ROI will come from, consumes gargantuan levels of resources, both technical and strategic. Navigating today’s big names through these historical waters – ensuring your decisions don’t consign your charge to nostalgia – takes nerves of green-energy steel. Therein also lies the clues to the significant manoeuvrings occurring in many OEM ownership structures: ensuring what needs protecting is protected and risk is shared among all with a future stake.

Neither is it unfair to emphasise the traditional incumbents in that sentiment. Wrong as it may be, the upstarts are still afforded a level of grace the household names are not. Maybe it reflects a society highly motivated by ideology, but equally so, the absence of an aftersales track record. Failing in the latter is where the seeds of end- user disillusion lay inducing a return to that which is comfortable.

Don’t think for a moment the information revolution is done with us, either. Much of today’s hardware advancement owes its genesis and ongoing relevance to it. But it’s more than that. OEMs have taken the opportunity to push much deeper into their clients’ businesses. The days of buying the good wagon and tending to its needs yourself may not just be the domain of the fool- hardy; it might actually be impossible. Likewise, the standalone mechanical- repair business could be as much at risk as the humble diesel/petrol station.

Consultative purchasing, predictive fleet maintenance, guaranteed buy-back, swathes of additional telematics, battery status, recharging strategies and route optimisation will be the conjoined siblings of alternative propulsion.

While the cynic within might say, ‘Don’t think for a moment all that telematic data collected over the past three decades was all about you,’ there is a lot to be gained for OEMs who can take customers’ hands and collaborate in navigating the complex fog ahead. Whether the end user’s balance sheet has experimental wriggle room or not, providing solid, comforting, practical advice in the next decade may well set up a beautiful union for the two, three, or more that follow. In tomorrow’s world, the peak consideration in any potential change of supplier will be the collateral damage of an interrupted data stream.

Neither is any of that even touching on the blockchain- encrypted data security of the truck, load and driver. Even Orson could not have imagined Blockchain, and that we’d all be each other’s big brother,

Then there’s the ‘why?’ As sad an indictment as it may be, the moment climate and emission levels cross that threshold of being the next ‘must-have’ on the corporate string of bunting, that’s actually when we’ll have the impetus we need. The last great addition was health and safety, and unlike the dignity-stripping levels that achieved, this one can’t really be overdone. This has nothing to do with the journey; it is only about the destination.

The sobering condition, of course, is the ability of politicians to ensure the network is there to support the tsunami of product flowing onto the market. That’s not to say they’re in charge of physical provision; God help us in that case. They need to create the legislative, compliance, and consenting framework that allows the ‘doers’ to ‘do their thing’. That can’t be hard, can it?

Suffice to say, if we were to take 50 years as a yardstick by which to measure a civilisation- altering level of change for those engaged in road transport, the half- century from 2010 will likely resemble that from party lines to the iPhone 15.

This month: the indoor displays of our big six. (You really can’t comprehend the scale of this show – Ed.)

DAF

After all that, let’s get underway with diesel. It might be the last time we can. The big news was DAF’s new XD series regional distribution and construction (XDC) range taking out the International Truck of the Year 2023 Award. It meant DAF has won the coveted accolade two years on the trot. A rare feat indeed.

Think again if your first thought is, ‘Not surprising considering the truck has the same DNA as its big siblings and last year’s winners, the XF, XG, and XG+.’ The XD had to fend off Scania’s ‘Super’ longhaul driveline and the Mercedes-Benz Actros with the third-generation OM471.

The XD really is a little honey, a truck you take a shine to the instant you see it. In non-XDC form, it’s low, with a curved windscreen delivering class-leading vision, low belt lines, digital ‘vision dashboard’, and DAFs Digital Vision System (camera rear-view).

Based on PACCAR’s Euro-6 MX-11 and ZF TraXon auto-shifter combo, the IToY judges considered criteria, including technological innovation, comfort, safety, driveability, DAF’s XD won the International Truck of the Year Supreme Award for 2023. (Inset) IToY President Gianenrico Griffini presents DAF president Harold Seidel with the award in front of world media. fuel economy, environmental footprint and total cost of ownership when amassing the 134 votes that saw the XD series cross the line in first. You can’t help but see yourself happily leaving somewhere like ‘Foodies’ for a cruisy South Auckland or Christchurch regional delivery round! The trucks go into production in autumn (Europe) this year, i.e. now. Arrival on our shores? We contacted Richard Smart, general manager of sales at Southpac Trucks, who told us, “potentially 2025, 26”.

Time for a nice segue… XD will also be available in DAF’s upcoming BEV range. Of course, DAF was a pioneer in ‘eDistribution’ in 2018 with the CF and LF BEVs, with a range back then of 200km and 280km, respectively. This year, it announced XD and XF in BEV format, upping the game considerably with PACCAR EX-D1 and D2 permanent-magnet e-motors with outputs from 170kW (230hp) to 350kW (480hp), and a modular battery string system that will give ranges between 200 and 500km on a single charge. Able to take fast DC and AC charging, a three-string pack on a 325kW charger can be boosted from 8% to 80% in 45 minutes, and the largest pack from 0% to 100% in two hours.

Optional is an onboard charger enabling AC charging of up to 22kW. That is obviously a slower process, but it allows operation when fast charges are unavailable.

With the right route-planning and charging strategy, DAF says operators can achieve 1000km fully electric per day. The 2-5 string pack starts at 170kW (230hp) and 1200Nm (885lb/ft), and we end up at 4-5 string packs that top out at 350kW (480hp) and 1975Nm (1457lb/ft). Don’t attempt to reconcile that to anything you know unless you’ve driven an EV. It’s a whole new world.

DAF makes a big thing of providing clean rails for bodybuilders to work with. Well done, them. Battery strings can be ‘tuned’ to application, allowing room for crane legs and the like. A 650V ePTO is available for the auxiliary kit.

Starting series production in the first half of 2023 at a new facility in Eindhoven, the Netherlands, the new models will be available in 4×2 tractor and 4×2 and 6×2 rigids with a top GCM of 50 tonnes. If you’re in Europe next year and you see a DAF with blue grille and headlight accents, that’ll be the strong silent type right there.

Daimler Truck

A huge presence with a strong and varied hand at the poker table. In 2018, Daimler had one series production zero-emission vehicle at IAA (eCanter). This year, there were eight. While Daimler firmly believes no one size fits all, its options currently comprise only diesel, BEV, and down the road, FCEV. “We are focusing on battery and fuel-cell vehicles because we are convinced our industry will need a dual strategy for sustainable transport in the future,” said Daimler Truck CEO Martin Daum at the media night. “We do not need a triple strategy that includes natural gas. Gas-powered drives are an expensive bridging technology that relies on fossil fuel and emits CO2 .”

Mercedes-Benz Truck CEO Karin Rådström gave a brief rerun through the Mercedes-Benz low- and zero-emissions story, which ended with the world premiere of the eActros 300 4×2 tractor for urban distribution, able to tow all common European trailers with a range of 220km, delivering 300kW continuous and 400kW peak power. Series production will begin in the second half of 2023.

Rådström emphasised the purpose-built aspect of the eActros range with rear-mounted twin-motor eAxles rather than a “quick-fix” development path that retains components such as prop shafts.

Sadly, for the 300, it wasn’t the centrepiece of the stand. That accolade went to the Mercedes-Benz eActros LongHaul 4×2 tractor. It was announced in 2020 and follows the commercial launch of eActros rigid for heavy distribution last year. The unit previewed the design language intended for the series-production machine. First prototypes have been in full testing, and in the coming year, near-series prototypes will head to customers for further rigour.

Vital stats on the 4×2 unit comprise a 500km single-charge range and three battery packs with a capacity of 600kWh. Two electric motors form part of a new eAxle generating a continuous output of 400kW and peak of more than 600kW. There will be rigid variants at launch and durability will compare with a conventional long-distance Actros at 1,200,000km over 10 years.

Batteries for eActros LongHaul are lithium-iron phosphate, the increasingly popular choice among OEMs for reasons of service life and useable energy, able to charge from 20% to 80% in under 30 minutes on a charge output of about one megawatt. Planned for series production in 2024, the truck will be built on the line at the plant in Wörth, Germany alongside conventional units.

Mercedes-Benz also raised the potential e-trailers bring to the party, citing a range extension of up to 800km with the right mix of componentry.

No surprises that the eActros LongHaul will be wrapped into the ecosystem of consultative services to ensure optimum uptime and use, including Daimler Truck Financing for both truck and infrastructure at the customer site. Interestingly, Rådström said the eActros LongHaul would have “a much lower energy consumption per kilometre compared to diesel, less than half. We expect to have lower running costs and over the course of a common operating period – five years and 120,000km per year – this truck can amortise as well as a diesel truck.”

Infrastructure-wise, Daimler’s involvement in the Traton and Volvo Group tripartite project, delivering 1700 fast charging sites across Europe’s big freight lanes, was a key message in Daum’s address, as was the need for bureaucrats to start making serious headway on the infrastructure issue. Once up, the tripartite network would be brand-agnostic.

Also spoken about was Daimler’s involvement in the High Performance Charging in Long Distance Truck Transport (HoLa) project, under the patronage of the German Association of the Automotive Industry (VDA), essentially a body planning the construction and operation of a selected high-performance Megawatt Charging System (MCS). Four sites in Germany are being set up and evaluated.

Later in the decade will come Mercedes-Benz FCEV products, key to its offering in the longhaul space where demanding conditions and increased flexibility are required. Its GenH2 trucks are in test-track and public-road testing, with the company looking to ranges of 1000km and more.

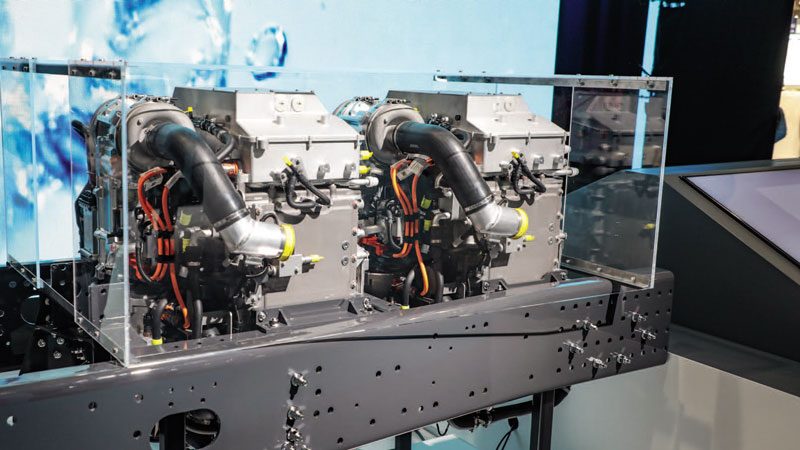

Daimler prefers liquid hydrogen over gaseous, citing increased energy density carried providing for longer ranges. The trucks will hold the fuel in two tanks, each comprising two sleeved stainless-steel vacuum-insulated tubes capable of carrying 40kg each. In series production, the fuel cell will provide 2 x 150kW and the battery 400kW additional situational assistance via a 70kWh capacity battery. Payload goal for the series-produced unit is 25 tonnes on a 40-tonne GCM.

In 2021, Daimler Truck and Volvo Group joined forces with fuel-cell manufacturer Cellcentric to produce fuel cells for their respective offerings (more on that next month). Daimler Truck is also working with Linde, developing a new process for handling liquid hydrogen – subcooled liquid hydrogen technology (sLH2). The goal is for a refuelling prototype station in 2023, with high levels of transparency and collaboration across industry to ensure a mass-market standard. A shareholder in hydrogen filling station, H2 Mobility Deutschland, Daimler Truck is planning to work with Shell, BP, and Total Energies on hydrogen-filling capabilities on important routes across Europe. Meanwhile, Daimler Truck, Iveco Group, Linde, OMV, Shell, Total Energies and Volvo Group will be working together to create conditions for a mass-market roll-out of hydrogen trucks in Europe as part of the H2Accelerate (H2A) interest group.

If you need a breath of more familiar air, Mercedes-Benz Actros L (Limited) Edition 3 was on the stand with the new Actros F. Why were they there?

“The transition to CO2 -neutral road transport is in full swing. For the transitional phase, we aim to further optimise our premium trucks with conventional diesel engines in the interests of our customers, to sustainably reduce TCO, and to reduce the CO2 footprint,” said Stina Fagerman, head of marketing, sales and service at Mercedes-Benz.

The L has a limited run of 400 units for the customer who wants ‘the works’, whether luxury, efficiency or safety. The F, on the other hand, is aimed at the more functionally focused client. Both trucks have the Gen-3 12.8-litre OM471 motor, offering up to 4% improvement in economy on the previous iteration. Both have Active Brake Assist 5 (ABA 5), and Lane Keep Assist. Sideguard Assist is standard on the L and optional on the F, and the L also comes with second- generation mirror cam, or Active Drive Assist as an option. Mercedes-Benz Complete Mile and Uptime support packages come recommended for optimal TCO.

Right, back to tomorrow, and something almost familiar to us, eCanter. I say ‘almost familiar’, because this is Next Generation eCanter, launched at IAA and the result of knowledge gained from more than 6,000,000 eCanter kilometres around the globe since the truck’s launch in 2017.

Range was, of course, a feedback highlight, and the new truck with three different battery packs can provide ranges from 70km to 200km, as well as AC and DC charging. There are 42 variants now, with wheelbases from 2500mm to 4500mm, and GCMs from 4.25 to 8.55 tonnes.

Two sizes fit all in terms of cab width, with a 1.7m and 2.0m options and, speaking to safety, eCanter sports ABA 5, Active Sidegaurd Assist, and to prevent the wee fella sneaking up on people, an Acoustic Vehicle Alerting System (AVAS) when turning on the kerbside. Beep beep.

IVECO

IVECO is no stranger to taking on alternative fuels with gusto, having played in the gas space for many years. Then there’s its direct association with Nikola Group via the CNH Industrial investment when it lived fully under the brolly of that conglomerate.

More recently, IVECO has been active in the BEV space across multiple vehicle end-use strata under both the IVECO and JV Nikola brands.

IVECO, MAN and Mercedes-Benz have a major advantage heading into the new era of transport, able to offer the full gambit from last mile to line linehaul under one brand, which means aftersales support, fleet-wide operational data, and just as important at this time, emotional comfort. That’s a compelling sales point.

IVECO’s 4300m2 exhibit backdrop in white and blue was the most striking; the colour choice itself a message to the world, announcing the new base colour for the company logo – ‘energy blue’.

Luca Sra, president of Iveco’s truck business unit, spoke about the company’s roadmap to sustainability encompassing “trustworthy, sustainable and intelligent transport solutions” and a “move to net zero carbon by 2040 through an all-range multi-energy approach”.

Key to those aspirations on the stand was the new eDaily, the Nikola Tre BEV European 4×2 artic, and beta versions of the fuel-cell Daily and European 6×2 version of the Nikola Tre FCEV.

Starting with eDaily, which is a huge one to nail in terms of ensuring one of the most useable and configurable LCVs retains everything we love when something other than ICE is propelling the show. All body variants have been retained, with the option of an ePTO up to 15kW. Native power comes via a 37kWh modular battery set-up maxing out at 111kW. At the high-end, power tops out at 140kW and torque at 400Nm, with range anywhere from 110km to 300km (WLTP), and a potential of 400km if you line up your ducks just right. When reality bites, that may be an aspirational figure. IVECO says the configurability allows “range optimisation”, and it is donkey-deep in sage advice to ensure customers get what they need, know what’s happening, and know how to optimise every moment once hands are shaken and deals are done.

Helping to open the alternative-propulsion door and easing transitional stress on the customer base, IVECO announced plans for its innovative Green and Advanced Transport Ecosystem (GATE) business model. This all-inclusive long-term BEV/FCEV rental model will also include an exclusive and innovative EV-dedicated pay-per-use formula. Continuing on a theme, IVECO Services is the soon-to-be-launched umbrella incorporating all integrated services supporting customers’ operational and business decisions. One size no longer fits all.

Nickola was on the IVECO stand, obviously – no need to explain that – and big EVs are its game. Orders are open for its 4021mm wheelbase 4×2 European BEV tractor unit. Nine batteries storing 738kWh, delivering up to 530km range, with an 80% charge on a 350kW charger taking about one hour and 40 minutes. Output is 480kW continuous delivered to an FPT-manufactured eAxle (FPT is IVECO’s powertrain brand). The pitch for the BEV Nikola is hub-to-hub and regional hauling.

For the big jobs, Nikola will soon have its FCEV available (US production ex-Coolidge, Arizona, Q4 2023, and European ex-Ulm, Germany, Q1/2 2024). On display was the beta prototype (production representative) and an impressive sight it was. In 6×2 trim with a steering tag axle and 3932mm wheelbase, the truck will clock up 800km with 70 useable kilogrammes of hydrogen stored at 700-bar. Refuel time is 20 minutes.

“IVECO and Nikola enjoy a solid partnership that began in 2019,” said Gerrit Marx, CEO of Iveco Group. “Together, we have met every milestone on our path toward deploying zero-emission heavy-duty trucks and North America and Europe.”

Sticking with FCEV, IVECO also had its beta FCEV Daily on display, with a Hyundai 90kW Hydrogen fuel-cell system and 140kW eMotor, with battery pack by FPT. GVM is 7.2 tonnes, with a three-tonne payload and 350km range. Refuelling time is 15 minutes. The FCEV Daily’s pitch will be tasks, where eDaily’s range runs shy of the mark.

Much of the remaining stand visited IVECO’s well-documented journey in compressed and liquified gases to date. And like other OEMs, that spoke to the role they may well play in bridging the divide between zero-emissions aspiration and actuality… for the next decade at least.

Continuing the theme, displays demonstrating the efficiencies that can be gained in driving Euro-6 diesel engines were also present, as was a celebration of the marque’s famous Turbo Star brand in the form of a swanky- as red S-Way. What a comfort that was in a strange new world.

Scarily, in the far corner was the IVECO Plus autonomous driving S-Way display truck. Suffice to say, goodness knows what IAA Transportation 2030 will be like.

But one thing is without question: whether it’s EV, hydrogen, gas or diesel-powered, and even if it drives itself, S-Way is a sexy truck. Can’t wait for the day it graces our part of the world… early next year, by all accounts.

MAN

Like it’s Traton Group stablemate from the north, the Lion’s roar at this point is all about BEV.

“For the mobility of tomorrow and sustainable, climate-neutral transport, MAN Truck and Bus firmly believe that battery-electric drives are the way forward,” said Alexander Vlaskamp, MAN’s CEO. Of course, we know there’s an FCEV project underway in the wings.

MAN leans on its experience in the EV world via buses, vans and eTGM distribution offerings to help soothe the anxieties – a ‘We got this!’ sort of approach.

The centrepiece of its stand was the eTruck in what it called “near-series prototype” status. In 2019 and 2020, we visited and drove MAN’s new-generation TG series – a truck yet to arrive on our shores – and talked about its underlying preparation for a new tomorrow. That new tomorrow is upon us, and it will be game-on in 2024 when MAN and Mercedes-Benz both bring their linehaul 4×2 BEVs to market.

The MAN eTruck tractor in 3750mm wheelbase, 4×2 configuration presented with an electric motor in 300-350kW, four-speed transmission, and hypoid drive axle i = 2.53 (final drive). The Lion boasts daily ranges of between 600km and 800km and up to 1000km in the future, says MAN. Ranges are contingent on some form of charging, with the truck built for high-capacity rapid turnaround megawatt charging.

Twenty units have been launched at the Munich plant, where the trucks will be made on the same line as their diesel-powered cohorts. Flexibility to build what the customer wants is at the heart of that decision. It must also be more cost-effective than a green-field site, surely?

Electric trucks need batteries, and in addition to funding from the Free State of Bavaria, investment in the Nuremberg MAN plant is well underway, which will see 100,000 battery packs produced per year from 2025. MAN sees battery production and sustainability as core goals and, as such, there are stringent supply- chain conditions on materials used in battery manufacture as well as the pursuit of a 97% recycle rate for all raw materials used.

Like all OEMs, MAN says the eTruck is infinitely flexible, just like a diesel wagon, and like all OEMs. There’s also a strong suggestion that to achieve that, MAN helps determine all aspects of purchase, configuration and operational parameters, e.g. route planning and recharge strategy, not to mention assessing telematic feed from the trucks. MAN ReadyCheck and eManager drill into the depths of all that.

Standby for lots more on this machine soon.

EV success will hinge on infrastructure as we know, which in most cases, will start at the customer’s depot. Traton Group founded the OEM collaboration with Daimler Truck and Volvo Group to stand up the 1700 fast- charge locations across key European sites.

The rest of the MAN stand was a festival of combustion and a celebration of the famous marque’s broad mix of capabilities, including construction, severe terrain, construction, heavy-haul, regional and metro distribution and, of course, linehaul.

Trucks without mirrors aren’t even a talking point in Europe anymore, and except for the last-mile contingent and the “Euro-5 6×4 for the Australian market”, MAN’s OptiView adorned the entire display. The Lion S trim that has all the extras made a spectacular appearance in both TGX and TGSS models, making its first appearance on the latter at the show, adorning a 41.520 8×4 BB CH construction chassis.

On the topic of ‘The show’s not over yet’, the company’s new version of the D26 engine was launched at IAA 2022 also, sporting an extra 7kW (10hp) and 50Nm (37lb/ft) across the range. With engine and aero refinements, operators can expect up to 4% improvement in fuel burn.

MAN was more than bullish on what comes hot on the heels of alternative propulsion, meaning autonomy and, not really hot on the heels, to be honest – potentially contiguous in certain applications. The biggest potential disrupter to optimised e-efficiency is the driver, and next to infrastructure, they’re also the scarcest resource. Infrastructure we can fix, the other problem has been unfixable around the globe for nigh on three decades, and as such, the autonomous mood was an undercurrent beneath the surface of many exhibits. MAN cited a reduction in human error, elimination of HR-related compliance and unattractive long-haul tasks, plus the ability to place humans in varied and demanding tasks as key attributes of autonomy. The company talked about its ANITA intra-terminal project with Deutsche Bahn (German Rail), as well as the hub-to-hub ATLAS-L4 project that is scheduled to see L4 autonomous trucks on the German motorways by the end of 2024.

Scania

“Standing at the brink of the biggest change in our industry” is how the president and CEO of Scania and parent Traton Group, Christian Levin, summed up where we all find ourselves in history.

The pointy end of global truck manufacturing doesn’t get any ‘pointier’ than Levin and his peers. When they’re all singing the same tune, rest assured public-bar cynicism is about as relevant as a group therapy session at the Kremlin.

Although Scania is singing BEV as the ultimate solution at this stage, “the future is sustainable, the future is BEV”, it also affirms there are no silver bullets, and as such, it has enough eggs in its basket to ensure no door is entirely shut.

Scania offers a comprehensive phased transition for the less maverick in the customer base, meaning diesel, CBG and LBG (compressed/liquid biomethane gas) combustion providing choices enroute to HEV (hybrid, not the other H), and ultimately, BEV.

Scania won the European Green Truck Award in 2022 with its €2 billion Super Series diesel and bio-fuel engine platform. It’s the sixth year in a row the Griffin has won the award, and certainly offers early options to the most risk-averse. From there comes the expansion of its biogas engine range, with two new 13-litre CBG and LBG engines, rated at 311kW (420hp) and 340kW (460hp), respectively. Biomethane can reduce CO2 by 90% from a wheel-to-well perspective, and both engines have been developed with performance characteristics aligned to the Super Series motors, so operators experience comparable performance.

“Tractor and trailer combinations for long-haul applications with train weights of 40 tonnes can now expect ranges up to 1400km with liquified biomethane in their trucks,” said Stefan Dorski, senior vice president of Scania Trucks. He said with the rate of network roll-out for refuelling gas engines increasing, Scania Trucks offered a strong alternative for customers wanting to reduce their fossil-fuel footprint. “It does not mean you have to give up anything in driveability, flexibility, or driver comfort.” Orders for the new biogas engines can be placed in Europe in Q3 2023.

A true sign of the times was Scania’s central inside display being devoted to new connected services – My Scania and the Scania Driver’s App – as well as BEV charging solutions. As stated at the top of the article, the digital relationship between OEMs and customers will likely be the cornerstone of the physical relationship going forward, and with 600,000 connected Scania’s currently roaming the globe, there’s an awful lot they already know. Predictive maintenance and BEV control packages will form part of Scania’s labyrinth of digital and commercial business support.

Scania also showed a prototype megawatt charging system (MCS) station provided by the CHARIN alliance. High-powered charging of 1MW or more would make it possible to recharge long-distance trucks in about 45 minutes – the driver’s mandatory rest break (local compliance). Final standards are yet to be determined, but the goal is a safe single-plug system and unified charging-location point on trucks, allowing the interface to be automated. The goal is also to incorporate V2X (vehicle-to-grid) communication.

The availability of CCS (combined charging system) and MCS charging points for European customers is vital if widespread uptake is to happen and that’s at the root of the Traton- Mercedes-Benz-Volvo Group collaboration that will see 1700 installations on major European corridors.

Scania had three BEV trucks – two urban and one regional – and a bus on the indoor stand. BEV is where Scania’s main fossil- free pitch is, and in June, it released the regional long- haul 40 R or S with 400kW (560hp equivalent) and the 45 R or S at 450kW (610hp equivalent). Again, modular architecture is the blueprint, with 4×2 tractor and 4×2/6×2 rigid configurations available. Range is 350km on a 40-tonne, tractor and semi, six battery set- up. Recent dimension changes in Europe allow a 4×2 tractor to carry the six batteries required. Range on a 64-tonne 6×2 Nordic combination is 250km. Opportunity charging – e.g. rest break/depot – in the course of a day on 375kW charger would improve flexibility considerably.

“We can now offer solutions for a range of applications,” said Fredrik Allard, senior vice president and head of electrification at Scania. “These additions will serve as a launch pad for a transition for all kinds of customers.”

The Swedish giant has been hugely vocal on its environmental mission beyond the end product, placing what it calls science-based targets around production and pushing deep into its supply chains with emissions expectations of its suppliers. A 50% reduction in CO2 from operations between 2015 and 2021 and 25% less energy per produced vehicle in the same timeframe are two examples.

Scania, too, rang the autonomy bell. Mobility solutions include the wholly owned subsidiary LOTS Group, a unit formed in 2021 to capture market opportunities in the future transport ecosystem. The unit drives the development of new business models outside the current core business, increasing Scania’s role in the transportation and logistics value chain, as well as developing and commercialising the autonomous offering. If you can read between all the lines in that paragraph, there’s much to ponder.

Volvo

Playing ‘find the internal combustion engine’, was a complete waste of time on the Volvo stand. They were absent. While it and other cleaner combusting options do, and will, continue to play a key role in the company’s offerings for some time yet, Volvo Truck President Roger Alm wanted to send a clear message. “We need to act now, not wait for future solutions. It is a competitive advantage to go electric now, and it will be even more into the future.”

The position he was speaking from was being the only OEM offering a complete BEV truck package from the FL’s 10-tonne GVM to the FH tractor at 44-tonne GCM. The latter was released in early September and assembled with its combustion-powered brethren on the same line at the Tuve Gothenburg plant. Although only in tractor configuration currently, Alm affirmed the FH rigid’s arrival in 2023.

Regarding BEV market share in the weight classes in which Volvo competes, Alm said the company had 30% in Europe and 60% in North America. To date, Volvo Trucks had sold 2600 units in 27 countries.

Head of global product management at Volvo Trucks, Jessica Sandström, said 50% of European truck journeys were 300km or less, and a considerable dint in the transport task could be undertaken on overnight depot recharging on non-high-capacity chargers. That stat probably applies to many Western truck markets the world over.

Citing data from a project the company has undertaken using independent researcher Ipsos across 1000 buyers of transportation in Europe, Sandström revealed 78% were willing to pay more for no or low CO2 transport, 85% would change transport suppliers if they couldn’t meet their targets, and 60% thought they would lose customers were they not able to meet targets. The numbers are telling and reinforce the fact emissions reduction is on the way north if you’re in search of marketable qualities for your business – qualities that end in real dollars.

Of course, not all Volvo’s future chickens are in the BEV basket, and FCEV via the Cellcentric collaboration with Daimler Truck, will play a crucial part in its heavy-weight long-distance forward offerings. Alm said testing continued, and the first of those machines would find homes with selected customers in 2025.

Collaboration is king, and Sandström addressed the hot topic of energy availability, citing the Volvo-Daimler- Traton collaboration on the 1700 European charging stations, as well as internal strategies around dealership charging. Sign up a new Volvo BEV and you also get a charger as part of the package. Then, of course, there are the plethora of tech, data, maintenance and commercial support packages that will be part and parcel of tomorrow’s buying decisions.

Volvo, of course, emphasised its stellar reputation for safety would not in any way be compromised in a BEV-FCEV future, saying today’s passive and active safety features are all there, and things like side impact on their BEVs far exceed the requirement.

“In the crash tests, we have made sure the electric system turns off and that the battery system stays in place in event of an accident.”

Other safety-minded developments include Active Grip Control, designed to keep the high torque characteristics of the EV set in control.

In terms of unveilings, the key one was the company’s eAxle, due to go into series production in about two years. It incorporates the electric motors and transmission and allows room for additional batteries.